04

Sep

When shopping for auto insurance, one of the most important choices you’ll face is selecting your deductible. Many drivers focus on coverage limits, monthly premiums, or discounts, but your deductible has a direct impact on both your out-of-pocket costs and your insurance rates. Choosing the right deductible can save you money—or cost you more—depending on your driving habits and financial situation.

In this guide, we’ll break down what an auto insurance deductible is, how it works, what factors to consider when choosing one, and how to decide the best option for your needs.

What Is an Auto Insurance Deductible?

A deductible is the amount of money you agree to pay out of pocket before your insurance company covers the rest of a claim. It applies primarily to collision and comprehensive coverage, not liability coverage.

For example:

If you have a $500 deductible and $2,500 in damage after an accident, you’ll pay the first $500, and your insurance pays the remaining $2,000.

If repairs cost less than your deductible (say $400 when you have a $500 deductible), your insurance won’t cover anything.

Types of Auto Insurance Deductibles

While most policies use a fixed dollar deductible, some insurers also offer variations. Here are the common types:

Collision Deductible

Applies when your car is damaged in an accident, whether it’s your fault or not.

Comprehensive Deductible

Applies to non-collision incidents like theft, vandalism, fire, storm damage, or hitting an animal.

Disappearing/Vanishing Deductible

Some insurers reward safe drivers by reducing their deductible over time without claims.

Zero Deductible

Rare, but some policies allow you to pay higher premiums in exchange for no deductible at all.

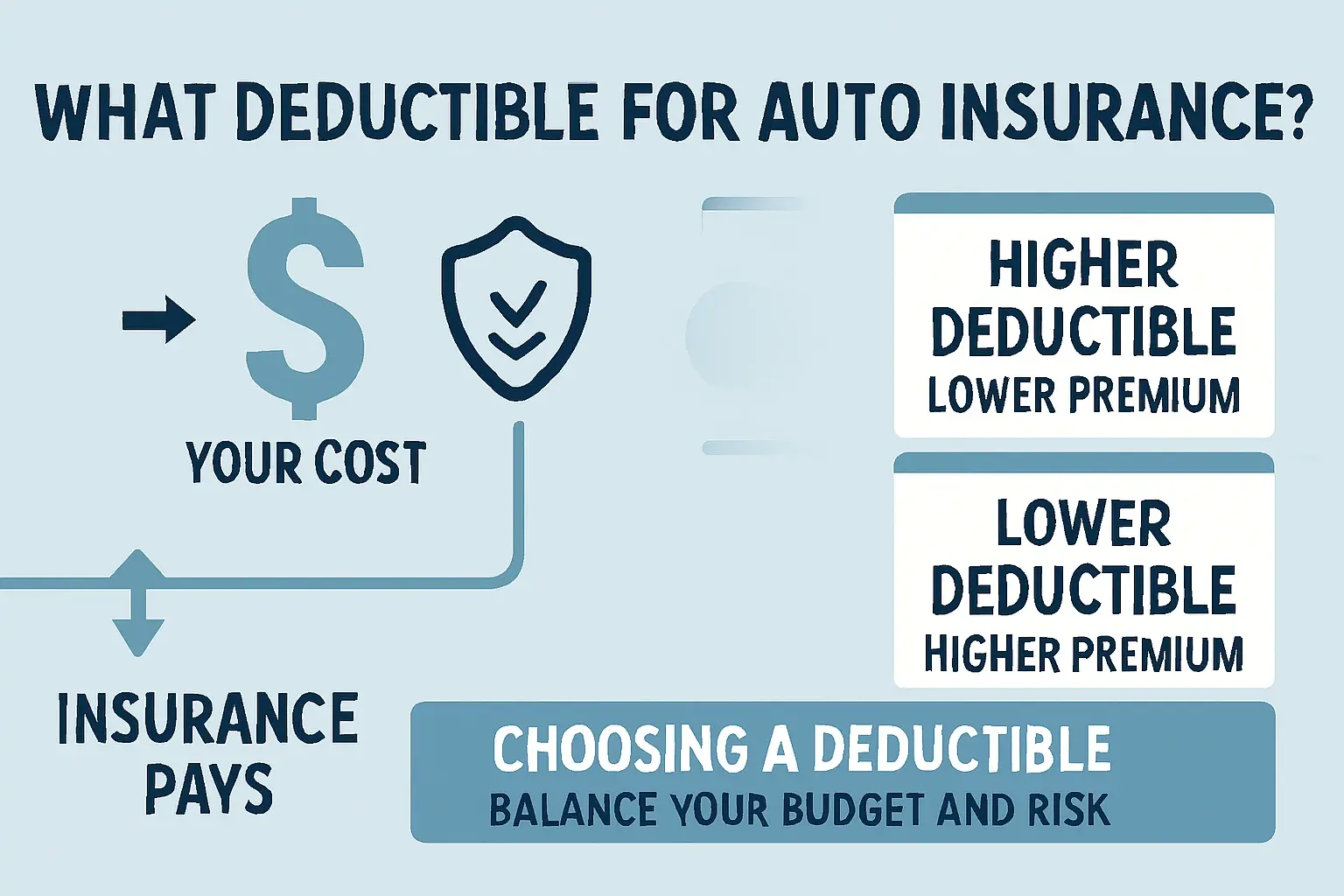

How Deductibles Affect Premiums?

There’s a direct relationship between your deductible and your monthly/annual premium:

Higher deductible = Lower premium

You’re taking on more financial responsibility, so the insurer charges less.

Lower deductible = Higher premium

You’ll pay less out of pocket if an accident occurs, but your insurer takes on more risk, so your rates go up.

Example:

A $250 deductible might increase your monthly payment by $20–$40 compared to a $1,000 deductible.

Over a year, that’s $240–$480 more in premiums just for the peace of mind of a lower deductible.

Common Deductible Amounts

Auto insurance deductibles typically range from $250 to $2,500, though most drivers choose between $500 and $1,000.

$250 deductible: Higher premiums but minimal out-of-pocket costs.

$500 deductible: Popular middle ground, balancing affordability and protection.

$1,000 deductible: Lower premiums but requires more savings to cover potential claims.

$1,500+ deductible: Best for high-income or low-risk drivers willing to self-insure more.

Factors to Consider When Choosing Your Deductible

Choosing the right deductible depends on your personal finances, driving history, and comfort with risk. Here’s what to consider:

1. Your Emergency Savings

Ask yourself: Could I afford to pay this deductible today if an accident happened?

If you have at least $1,000 in savings, a higher deductible may make sense.

If you live paycheck to paycheck, a lower deductible provides financial security.

2. Your Driving Habits

High-mileage drivers (commuters, delivery drivers) are more likely to file claims, so a lower deductible may be safer.

Low-mileage or safe drivers may benefit from higher deductibles since accidents are less likely.

3. Vehicle Value

If your car is older or worth less than $3,000–$4,000, a high deductible may not be worth it. You might even consider dropping comprehensive/collision coverage altogether.

For newer or financed cars, comprehensive and collision insurance with a moderate deductible is usually required.

4. Your Risk Tolerance

Some people prefer peace of mind knowing they’ll pay little in case of an accident. Others prefer saving money monthly, even if it means a bigger bill later.

5. Claim History

If you’ve filed multiple claims in the past, sticking with a lower deductible may prevent financial strain in the future.

Pros and Cons of High vs. Low Deductibles

High Deductible (e.g., $1,000–$1,500)

✅ Lower monthly premiums

✅ Better for safe drivers or those with emergency funds

❌ Higher out-of-pocket costs in accidents

❌ Riskier if you don’t have cash reserves

Low Deductible (e.g., $250–$500)

✅ Affordable in emergencies

✅ Peace of mind for frequent drivers

❌ Higher monthly premiums

❌ Long-term costlier if you don’t file many claims

Real-Life Example of Deductible Choices

Let’s imagine two drivers, Alex and Jordan:

Alex chooses a $500 deductible and pays $120/month for insurance.

Jordan chooses a $1,000 deductible and pays $95/month.

Over a year:

Alex pays $1,440 in premiums.

Jordan pays $1,140 in premiums—saving $300 annually.

If neither files a claim, Jordan comes out ahead. But if both get into accidents:

Alex pays $500 out of pocket.

Jordan pays $1,000 out of pocket.

This means Jordan’s savings from premiums could be wiped out after just one claim.

When Should You Raise Your Deductible?

Consider raising your deductible if:

You have at least 3–6 months of expenses in emergency savings.

You rarely drive or have a spotless driving record.

You want to significantly lower your premiums.

Stick with a lower deductible if:

You drive daily in heavy traffic.

You don’t have much savings.

Your area has a high rate of accidents, theft, or weather damage.

Tips for Choosing the Right Deductible

Match your deductible to your savings. Never set a deductible higher than what you can comfortably pay today.

Check your premium difference. Sometimes the savings between $500 and $1,000 deductible isn’t worth the extra risk.

Review your policy yearly. As your car ages or your financial situation changes, adjust accordingly.

Bundle with discounts. If you raise your deductible, pair it with safe-driver or multi-policy discounts to maximize savings.

Ask your insurer for quotes. Compare different deductible options side by side before deciding.

Final Thoughts

Your auto insurance deductible is more than just a number—it’s a financial decision that balances risk vs. reward.

A lower deductible provides peace of mind and immediate affordability in case of an accident.

A higher deductible reduces your premiums and is ideal if you have strong savings and low accident risk.

Ultimately, the right deductible depends on your budget, driving habits, and comfort level with risk. Review your options carefully, run the numbers, and choose a deductible that keeps you both financially secure and confident on the road.